Medical Device Coverage & Reimbursement Tips and Trends

Expert Advice from the 16th Annual Medical Device Coverage & Reimbursement Conference

A medical device sponsor must feel like they have successfully climbed Mount Everest when they receive their approval from the FDA – but in reality, they’ve only reached the first Base Camp. There is still a challenging uphill climb before receiving the real prize – reimbursement for their medical device.

To learn more about that process, I attended the 16th Annual Medical Device Coverage & Reimbursement Conference. This blog includes a few highlights to help guide your reimbursement journey:

Real-world evidence is required for successful payments

Payers increasingly request real-world evidence (RWE) for product adoption. Coverage decisions are based on data derived from non-real clinical trial (RCT) sources, such as: insurance claims, hospital charges, electronic medical records, patient registries, post-marketing surveillance, adverse event reports, genetics, sensors, and/or wearables, etc. “Consider developing an evidence program comprised of multiple studies with different sources, countries, time, geographies, and designs. This is far stronger than a typical study,” advises Sanjoy Roy, Director, Global Health Economics and Market Access, Johnson & Johnson.

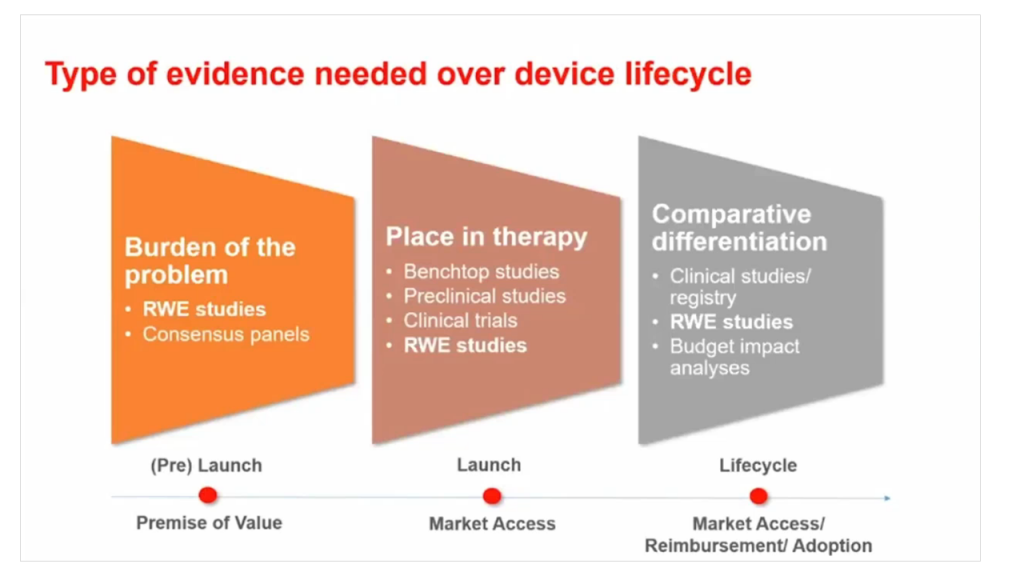

Types of evidence needed over a medical device lifecycle:

- Burden of the problem (RWE studies, consensus panels)

- Place in therapy (benchtop studies, preclinical studies, clinical trials, RWE studies)

- Comparative differentiation (clinical studies/registry, RWE studies, budget impact analyses)

This large volume of data is representative of outcomes and costs in the real-world and not affected by a prescriptive study protocol. An evidence program delivers long-term insights to uncover key relationships not on the clinical radar. If you are only using information from RCT sources, you might be using the wrong parameters for your value proposition (e.g. a surgeon saying, “None of my patients look like those in the clinical study.”)

Medical devices need to improve their value proposition

Medical devices lag behind the pharma industry in providing a robust enough value proposition to Payers. There is often no requirement for clinical evidence by the FDA prior to product launch. Safety and efficacy are often based upon a predicate. Unlike new drugs, new medical devices do not face the same demand for clinical outcomes. Not only is it costly to conduct controlled trials, it may not be feasible (i.e. you can use a placebo for drugs, not so for a pacemaker).

“Payers are placing greater emphasis on better patient outcomes, linking the provider or facility payment to quality of care,” states Crystal Riley, Deputy Director of Government Policy and Reimbursement, Baxter Healthcare. One path forward is value-based contracting. The Affordable Care Act led to an increase in value-based initiatives like evidence-based care discounts, where the device manufacturer pays healthcare providers’ costs if they do not meet certain metrics. Where to start? Designate a person/department that focuses on a value-based landscape. Consult with your Marketing, Regulatory, and R&D groups and build a cross-functional team to determine how to best collect the appropriate evidence. Using patient outcomes as a measure of value leads to better care, better diagnostics, and builds a strong value proposition for your product.

Collecting high-quality patient data takes time

A big challenge with patient-reported outcomes (PROs) is connecting the data with what exactly happened during the procedure. There are many confounding factors; you can look at physical function, emotional well-being, energy or fatigue, modified social support, or depression scale – all of these are qualitative metrics. For example, real-word evidence supports that minimally invasive surgery provides better outcomes in many procedures – less operative trauma, shorter hospital stay, less pain and a quicker recovery; but no two interventions are the same. The reimbursement structure is constantly evolving; codes can change every six months, with new body parts or procedures being recognized. This means your data collection also has to change.

How do you access retrospective data, or make new data work with older data sets? “Use machine learning/AI, applying keywords to trawl through codes to statistically assess patients’ outcomes from claims and surveys. Offer incentive to healthcare providers to collect high-quality, patient data,” suggests Emily Kim, Global Reimbursement & Health Policy, Intuitive. Otherwise this is an administrative burden that eats into the short time a physician spends with the patient. There are no codes for time spent collecting PRO data (yet), but this may change with the strong push for value-based payments.

Consider hiring a reimbursement support expert

Coding and billing for medical devices is not always straightforward. New devices, or products in a crowded market, could have special coding requirements. Payer coverage/management of a device may not be consistent. Some new, or even mature devices, may not be covered by the Payer, or could have an overly restrictive coverage policy. Determine the reimbursement needs for your specific device/customers/market. These could include: Payer coverage analysis, coding analysis, or benchmarking research to determine which levels of service competitors or manufacturers of similar devices provide.

Reimbursement support programs provide technical assistance to your customers (which may include patients, physicians, or healthcare providers), but can also be used to enhance the relationship between a customer and your brand. The right reimbursement support vendor depends on the services you require. These could include: coding support, benefit verifications, prior authorization assistance, assistance with appeals, co-pay assistance, or patient assistance (e.g. a free goods program).

Data reporting is critical for monitoring program volume and customer interaction and experience. “Reporting capabilities should be carefully considered as the data generated from the support program can help identity shifting market dynamics, reimbursement issues, and opportunities for customer engagement. It will also enable you to track Key Performance Indicators (KPI)s for the program and hold your vendor accountable,” recommends Zach Bridges, Director of Reimbursement and Market Access, ACell, Inc.

Select the vendor whose service offerings and experience are the right fit for your organization and customers. Include Marketing to gain alignment on the goals of the support program, and Compliance to ensure that any potential compliance issues are identified well in advance of discussions with vendors or program development. A cross-functional assessment of your reimbursement support strategy is crucial before program launch and will help you avoid unwanted surprises.

In closing…

Keep in mind these key points to guide you: 1) take time to gather real-word evidence and good patient data, 2) work this data into your value proposition, and 3) invest in expert support, including Marketing and Regulatory to ensure that you have the right reimbursement strategy.

So what happens if you fail to reach the peak of Mount Everest? Your medical device that could meet a medical need may never achieve market success. Without reimbursement, most patients will not be able to afford it. Payers want to improve the quality of care for their members – it is your job to convince them that your product is the right one to do it.

Lessons from the Medical Device Coverage & Reimbursement Conference go beyond this article. I look forward to sharing more insights in an upcoming white paper on ‘Reimbursement 101’ where I’ll discuss the basics of coding, coverage, and payment in greater detail.

Alexandra (Sandy) Reid is a StarFish Medical QA/RA specialist. She brings years of experience working in the industry. At StarFish she supported our Business Development team for two years before joining QA/RA.

Cartoon Credit: 11868543 canstockphoto