How to research the Infectious Disease Diagnostics market potential

The internet is full of great research data. This blog shows how to research four questions one should address when considering Infectious Disease Diagnostics market potential by using public information. I explain how publicly posted research and reports can help analyse and build answers for activities like developing a new PoC Assay.

- Who will buy my technology and who are my competitors?

Leading players in the diagnostic market are acquiring smaller technology companies that have produced new diagnostic tests. Meanwhile pharmaceutical companies, enticed by the opportunities in the in vitro diagnostic (IVD), market are either investing or collaborating with diagnostic devices companies to extend their drug value post patent expiry. This is often through the use of companion diagnostics.

Competition-wise, Roche Diagnostics and Abbott Laboratories are couple of major companies who have the added advantage of synergy between their diagnostic solutions and pharmaceutical solutions. Allere (NYSE:ALR) is the global leader in rapid point-of-care diagnostics. Their products, and new product development efforts, focus on infectious disease, cardiometabolic disease and toxicology. Other major players in this category include: Beckman Coulter , Becton, Dickinson & Co. (BD), bioMérieux , Bio-Rad Laboratories , Cepheid , Chembio Diagnostics Systems , DiaSorin, Grifols , Hologic, Meridian Bioscience, OraSure Technologies, Ortho-Clinical Diagnostics, Qiagen, Quidel Corporation, Roche Diagnostics, Siemens Healthcare Diagnostics, and Thermo Fisher Scientific.

- How big is the Infectious Disease Diagnostics market potential?

The global infectious disease diagnostics market is segmented based on test type, techniques, application, and end users. Market segmentation is further explored in my blog: Trends in the Infectious Diseases Point of Care (POC) Assay Industry.

Based on end use, the market is segmented into:

- Diagnostic laboratories (laboratory instruments with associated reagent kits)

- Academic and medical institutes (laboratory instruments and PoC with associated reagent kits)

- Contract Research Organization (laboratory instruments with associated reagent kits or with in-house assays)

- Hospitals and Surgical centers (laboratory instruments and PoC with associated reagent kits)

- Ambulatory clinics (PoC with associated reagent kits)

- Home healthcare (PoC with associated reagent kits)

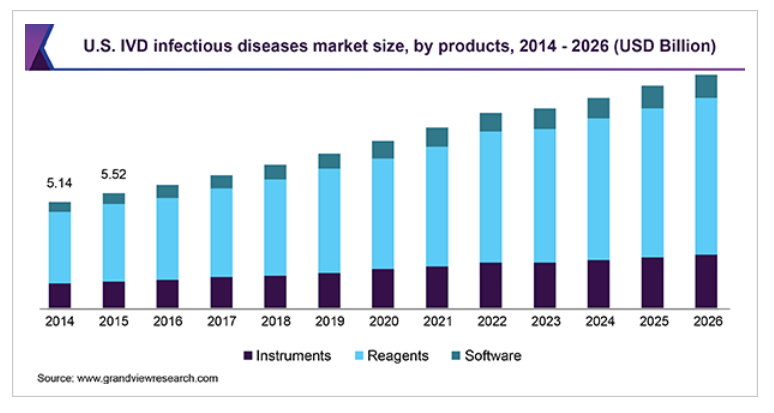

Products are categorized into instruments, reagents, and software. Reagents constitute various molecular diagnostic kits and immunoassays used for in vitro diagnosis of infections. Reagents held the largest share in 2018 owing to the presence of a wide range of kits and extensive usage of immunoassays in communicable disease testing.

Instruments are expected to witness lucrative growth in the next few years. Instruments are specially used for detection and analysis of clinical samples for infection causing micro-organisms. Some of the diagnostic instruments used in this market include:

- Cobas 4800 by Roche

- rapifleX MADLI by Bruker

- BD Max from BD biosciences.

- Kit, instrument…or both?

The global immunoassay market revenue generated over USD $19.1 billion in 2018. Cost-effective procedures, user-friendliness, and high acceptance rates in clinical laboratories are key factors attributing to the largest market share. Enzyme Linked Immunosorbent Assay (ELISA) and chemiluminescence immunoassays are the most widely used forms of immunochemistry over the forecast period.

The Immunoassay Market is expected to reach USD 34.44 billion by 2027 from USD 20.19 billion in 2018, at a CAGR of 6.1%[1]. Molecular diagnostic approaches and advanced improvements of immune-based detection platforms such as Perkin Elmer’s AlphaLisa system (developed from LOCI® technology) are poised to supplement and replace the existing ELISA based systems in the near (5-10 year) future based on improved accuracy, rapid results, and higher levels of specificity. Development of these diagnostic approaches is estimated to have significant growth over the decade.

Kit development companies are collaborating with molecular instrument manufacturers to develop assays for detection of infectious diseases. For instance, BD assay for MRSA detection is used in combination with Cepheid SmartCycler.

- Where will tests be used?

Central laboratories dominated the overall IVD infectious disease market in terms of revenue share. High procedure volumes, the presence of skilled labour, and an established infrastructure for handling infectious samples are factors responsible for the large market share.

Increasing demand for rapid tests, initiatives to reduce healthcare spending with shorter hospital stays, and a rising level of health conscious population are anticipated to increase market share of POC. The Compound Annual Growth Rate of POC testing for the infectious disease 2019 – 2026 is expected to be around 10.3%[2].

In 2018, North America was the highest revenue generating region with a revenue share of over 41%. Major factors accounting for the largest market share include a high level of R & D activities, the presence of sophisticated healthcare infrastructure coupled with high levels of disposable income, and technological advancements in the field of IVD infectious disease testing.

Developing regions such as Asia Pacific and Middle East and Africa (MEA) are estimated to offer a huge platform for potential growth of this market. Sub-Saharan Africa is reported to be the most affected region for HIV infections and HBV prevalence is highest in East Asia and Africa. Economic growth over the decade coupled with changes in lifestyle habits in this region is anticipated to provide epidemiologic transition boosting the growth of IVD infectious disease market.

For an excellent more detailed review of the global infectious disease surveillance and detection industry trends beyond the scope of this high level summary, please see: Global Infectious Disease Surveillance and Detection: Assessing the Challenges—Finding Solutions, Workshop Summary.

I hope this information is useful. I’d love to hear from readers about other public resources for IVD POC market data.

[1] https://www.marketsandmarkets.com/PressReleases/immunoassay.asp

[2] http://www.grandviewresearch.com/industry-analysis/ivd-infectious-disease-market

Nick Allan is the StarFish Medical Biotech Manager. He applies creative thinking and innovation to all phases of biotech projects including product definition and sustaining engineering.

Images: StarFish Medical